ROOFING | RESTORATION

At Pro Building, we operate solely on an Assignment of Benefits basis. With this in place, your claim is transferred to Pro Building to handle the details directly with the carrier and submit all of the expertly harvested documentation required to prove the damages.

In most cases, your deductible will be the only out-of-pocket expense for your claim.

We work from the position of being teammates with the homeowner - two parties with one goal - to restore your home.

Put our expertise to work for you today!

What we do

Expert Damage Documentation

In an age where insurance companies put profits before people and don't often tell the full story, professional documentation is the key to successfully restoring your property.

Expertly Trained Team

Comprehensive Photo Reports

Specialized Equipment

Thorough Documentation Process

Insurance-Ready Reports

Emergency Services

24/7 Emergency Response

Temporary Roof Repairs

Temporary repairs to keep you compliant with your insurance policy requirements..

Water Cleanup and Drying

Fully trained mitigation specialists to clean up, dry, and prevent further damage.

Fire Structural Cleaning

From charred homes to soot/smoke damage, we will expertly restore your home.

Roofing Repairs and Replacements

Damage isn't always obvious.

Missing shingles? Finding granules in your gutters and downspouts?

While these are typically signs of storm damage, did you know that some of the less obvious damage to components such as flashings, chimney caps, and gutters can slowly wreak havoc on your home?

Let us inspect your roof today - free of charge - and sleep well knowing that your home is protected.

What We Offer

When you're unsure of what to do, we're here to guide you through it

At Pro Building, we operate solely on an Assignment of Benefits basis. With this in place, your claim is transferred to Pro Building to handle the details directly with the carrier and submit all of the expertly harvested documentation required to prove the damages.

In most cases, your deductible will be the only out-of-pocket expense for your claim.

We work from the position of being teammates with the homeowner - two parties with one goal - to restore your home.

Put our expertise to work for you today!

Roof Claims

When storm damage hits, we’re your expert partner in navigating complex roofing claims, helping you get the coverage you deserve for a seamless repair or replacement.

Water Claims

Water damage can be devastating, but our thorough documentation and expert restoration services ensure your claim is handled efficiently, restoring your property to its original condition.

Fire Claims

In the aftermath of a fire, we’re here to meticulously document the damage and advocate for a full recovery, bringing your home back to life with expert restoration.

Liability Claims

When your property is damaged by a 3rd party, we provide comprehensive documentation and expert guidance to help you navigate liability claims with confidence and clarity.

Additions

Expand your living space with our expert additions, designed to blend seamlessly with your existing home while adding value and functionality.

Renovations

Transform your home with our expert renovation services, tailored to your vision and completed with the highest standards of craftsmanship and care.

Our commitment to quality drives every decision made for your home

Whether we're roofing your home, handling Roof Repair, or rebuilding it after a major disaster, you can rest assured that we will treat your home as if it were our own. Our skilled team approaches every project with the utmost care and attention to detail, ensuring that your home is restored to its best possible condition.

At Pro Building, we truly understand that your home is more than just a structure - it's where memories are made and lives are lived. That's why we take pride in delivering results that not only meet but exceed your expectations, giving you peace of mind throughout the entire process.

Why Choose Us

We work for you

Carriers hire their own teams of experts - adjusters, preferred contractors, engineers, and more - shouldn't you have your own team of experts connected through many restoration networks across the nation? Our extensive network will be working on your claim.

Expertise and Experience

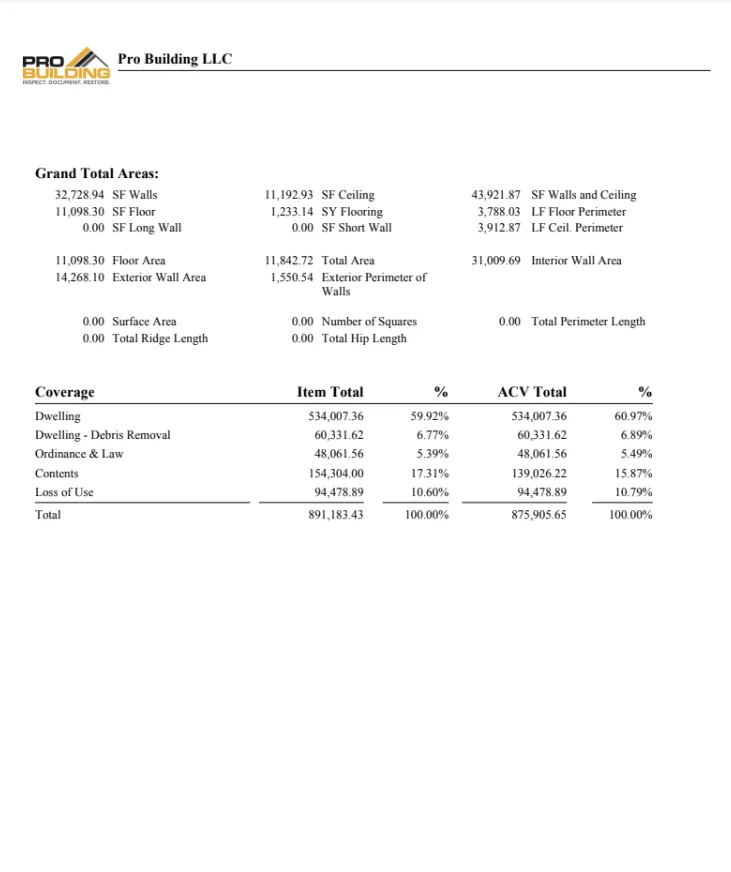

Since 2018, Pro Building has primarily focused solely on property damage restoration. Throughout this time, we have completed hundreds of property insurance claims across North Alabama.

Large and Complex Loss

From homes with 2+ claims to restorations over 1 million dollars, Pro Building has tackled it all. We routinely deal with both large and complex loss and are well equipped to document even the most demanding losses.

Dispute Resolution

Sometimes carriers just flat out refuse to do the right thing - and sometimes we have to get more aggressive to get a fair valuation on a claim. Pro Building is versed in many dispute resolution methods, Roof Repair, and even helps other local companies to settle their disputes with carriers as well. We pride ourselves on our deep understanding of the insurance policy as well as the appraisal process and our ability to navigate denials to get them overturned.

Professional Services

Comprehensive Claims Management

At Pro Building, we offer end-to-end claim management services that take the stress out of navigating insurance claims.

From detailed damage documentation to persistent follow-ups with your insurance provider, we handle every aspect of the process to ensure you receive the full coverage you’re entitled to.

What sets us apart is our deep expertise in both restoration and insurance, allowing us to advocate effectively for your restoration needs.

We don’t just manage your claim; we fight for it, ensuring that every detail is accounted for and that your home is restored to its rightful condition.

GALLERY

What all can you assist with in the claims process?

We handle the evaluation, documentation, restoration, mitigation, and cleaning of residential properties, all personal belongings (contents) evaluation and valuation, temporary housing, loss of use valuations, code compliance research, asbestos abatement, and mold remediation. Reach out to our team if you have a question on whether or not we can assist and we will gladly assess the situation.

What options do I have if my insurance claim is denied?

Once a claim is denied, overturning that decision becomes significantly more challenging. It requires meticulous documentation and strategic effort, far exceeding what would have been needed if done correctly from the outset. At Pro Building, we understand that the initial steps are crucial in this process. Our approach involves carefully assessing the reasons for denial, compiling comprehensive documentation to dispel any doubts, and presenting it in a clear, organized manner. While this doesn’t guarantee success, it is an essential step whether you're appealing to adjusters, supervisors, or preparing the case for legal action. By handling these critical early stages with precision, we help keep the door open for successful dispute resolution, ensuring your claim is given the best possible chance of approval.

If my claim is denied - will I owe Pro Building anything?

If your claim is denied, the contract that we have in place is an Assignment of Benefits for that claim. Because of this, if your claim is denied, there would be nothing owed to Pro Building for that claim. Now, if you choose to move forward with the project, even with a denial of the claim, you would be responsible for whatever amount is agreed upon between you and Pro Building to complete the work on the property. If there are any tarping fees or emergency services performed, regardless of the coverage of claim, the carrier usually pays for all mitigation efforts made since it is required by the insurance policy. Therefore, even if the claim is denied, those items may still be paid by the carrier and be responsible for payment to Pro Building by the insured.

Do I have to pay my deductible?

Unfortunately, the deductible is not something that we have any say over. This is an agreement that is in place between the insured and the insurance carrier. It is a pre-determined amount that you have agreed to pay if any claim arises and the rest of the risk is transferred to the carrier. Because of this, we are unable to "waive", "eat", or alter the deductible in any capacity. We have multiple options for financing including both in-house payment plans as well as official loans to assist if you need financing for your deductible.

Often times with roof claims, you may have some interior damage to the home. If you choose not to have Pro Building complete the interior damage, we will credit the interior ACV amount back to you for you to complete at a later time, which essentially would reduce the amount of money that you would owe out of pocket. This is not a tactic to get out of paying a deductible, however, and you should weigh the decision of whether or not the interior work is important enough to you to pay for at this time.

What additional options do you offer for my roof?

We have an extensive list of upgrades that you may choose from to improve the value, efficiency, or look of your home. The most standard items that people choose are:

- Fortified Roofing Upgrade

- Class 3/Class 4 Shingle Upgrades (Includes upgraded hip & ridge caps as well)

- Upgraded Pipe Boots (Our standard is already a free upgrade that we provide)

- Decking Thickness to 5/8" Upgrade

- Radiant Barrier Energy Efficiency Upgrade

Will filing a claim affect my insurance premium?

It's important to understand that claims resulting from Acts of God - such as storms, lightning, or other natural disasters - do not affect your individual insurance premium. By law, insurance companies cannot single out a property for rate increases due to such events. Instead, they must assess the combined risk of an entire zip code, adjusting rates for the area as a whole. If everyone in your zip code is already getting a new roof, your rate will go up regardless of whether or not you file a claim and get approval for the replacement.

On the other hand, water damage claims related to faults within your home's plumbing system can influence your premium. If a claim is filed due to a plumbing failure, your insurance provider may view this as a sign of potential future risks, which could lead to a rate adjustment. This is the same as with any fault within your electrical system as well. However, if the water damage is caused by a failing appliance, and that appliance is replaced, it usually won’t result in a premium increase as long as it's properly documented and underwriting is made aware of the replacement of the appliance. This is because the underlying risk has been mitigated by the replacement, reducing the likelihood of a recurring issue.

With most carriers, if you have not had a claim in the past 3-6 years, they will apply a policy discount of a few hundred dollars usually to your annual premium. Filing any type of claim has the potential to remove this discount if the carrier doesn't have some sort of policy in place for just having one claim on your recent history. After being claims free for 3-6 years (depending on the carrier's underwriting requirements), you will then be eligible for that discount to be applied to your policy again.

What time frame can I expect my project to be completed in?

The timeline for completing your project can vary based on several factors, the most significant of which is the insurance carrier's approval process.

The time required to capture and submit proper documentation is inevitable, but it's important to understand that the carrier's approval process can be quite unpredictable with some adjusters approving claims quickly for one company and another adjuster in the same company denying the same damage that was approved for the last client with a different adjuster. Insurance companies may delay, deny, or defend claims which makes it challenging to provide a definitive time frame until approvals are fully secured.

Once we have 100% approval from your carrier (less than 100% happens regularly and more documentation and waiting for the carrier is often required), our production process can move forward.

For roofing projects, we typically a lead time of about 3-4 weeks post approvals granted before we begin, with most roofs being completed in just one day - unless your roof is particularly high or complex, which might require an additional day or two. We do offer some quicker options for roofing to get houses sold and work to customize plans for our clients on timing if they're requesting a certain date for the roof to be completed by - this must be communicated to the representative of Pro Building so that we can adjust and plan accordingly.

For interior projects, such as a single bathroom claim, the average completion time is around 4 weeks post approval, unless remodeling, design changes, or further planning are involved. Kitchens generally take about 6 weeks post approval to complete, though, like bathrooms, this can extend if significant redesign or additional planning is necessary.

In some cases, the planning and design phase can take as long as the construction itself, depending on the complexity and requirements of the project. We strive to be as transparent and communicative as possible throughout this process so that you’re informed as we make progress.

F. A. Q

Frequently Asked

Questions

Here are answers to common questions about both claims and the resolution process.

TESTIMONIALS

What Our Clients Say About Us

James Craft from Pro Building, LLC was absolutely outstanding managing our new roof job. Took care of absolutely everything from beginning to end, from insurance claims and advocating on my behalf, to ensuring the most quality workmanship I have ever seen. James saved me a ton of time and $. Most professional representative I have ever worked with in the contracting industry. Highly recommend and will be using them again for other projects.

Keith Henderlong

Roofing/Interior Repairs

USAA Insurance Claim

Such an amazing company. The thought of having to go through the insurance claims process after a tree fell on our house was in short overwhelming. They helped me each and every step of the way, even going out of there way to put us in there own ALE program to help pay for a hotel room in providence without having to go through my insurance to start. I can't say enough about this company and can't recommend them enough.

Bobby Ross

Tree Claim/Roofing/Interior Repairs/

Temporary Housing

Gulfstream Insurance

After a bad storm USAA sent this company to do the inspection and submit it to them. After that I made the decision to use them for the repair. It took a bit of time since a lot of other homes had been damaged but the crew that came did the work quickly and efficiently, cleaned up all the mess. The best part was their patience while the mortgage company took their sweet time to release the funds from USAA. They are a great company and understood the process was slow. They waited and helped me navigate the situation with USAA and my mortgage company. I would use them again and recommend them for your home improvement needs.

Maria Hernandez

Roofing/Interior Repairs

USAA Insurance Claim